This carefully curated list provides essential resources for traders, covering reliable brokers, lot sizing, market sessions, forex correlations, and economic news—an invaluable toolkit for navigating the financial markets.

While this guide reflects a preference for brokers we’ve personally tested, it’s designed to empower you to draw your own conclusions with research.

1) BrokerChoose and WikiFx

A reliable broker should have:

- At least 5 years of being in the industry and more than 1 million traders

- Ability to pay out your profits quickly (eg, within 3 days~)

- Reliable spreads

- Quick execution

- Low commissions

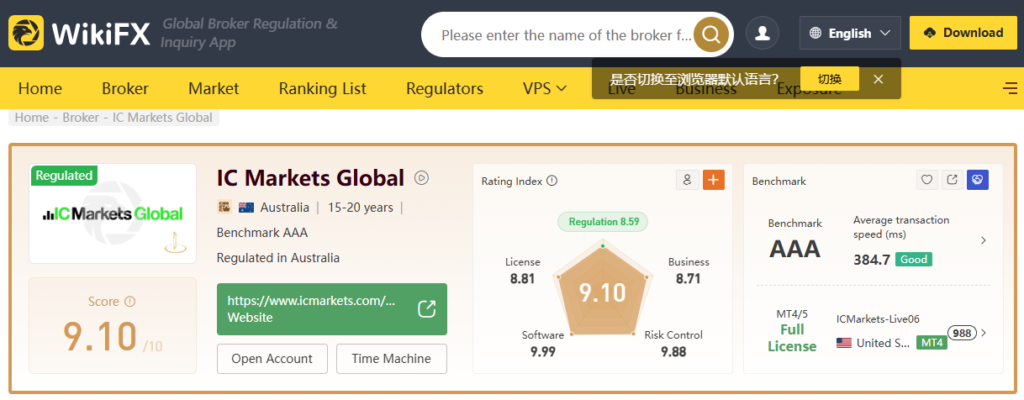

This is a screenshot capture from WikiFx on IC Markets. You can see where its regulated, the overall score, transaction speed, and other important details. Compare this with your brokers to decide. Do not assume your current broker is always giving you the best execution.

If you decide on using IC Markets, our referral link/code is 83515.

2) MyFxBook Forex Broker Spreads

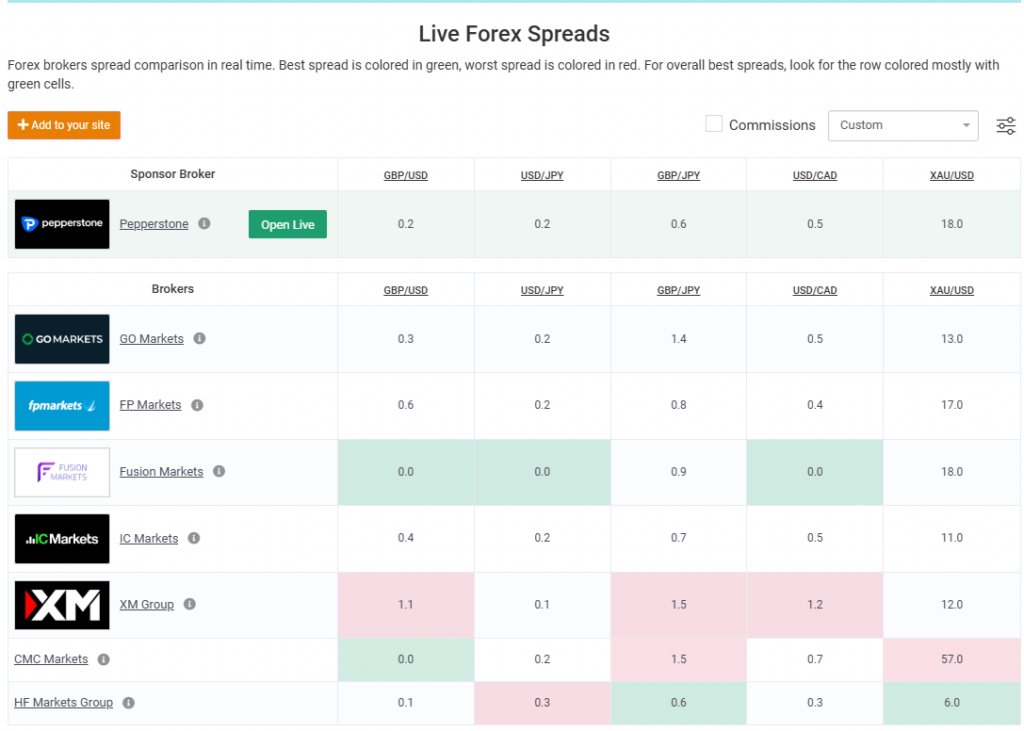

With all commissions cost the same, ideally, you would want a broker offering the tightest spreads possible. From this screenshot, HF Markets Group’s spread is lower on XAU/USD but its commission is double that of IC Markets.

BluFx’s algo works well with HF Markets and ICMarkets primarily because of the low spreads offered and execution speed.

A tiny difference in pips could be the defining factor whether our STOP LOSS or TAKE PROFIT gets triggered. It would be a big pity if our trades are stopped out before reversing to our favour due to spreads. Likewise, our profitable trades are not closed promptly after reaching its price level due to wider spreads.

While brokers love to entice retail traders with low commissions, we found spreads to be the most important factor.

3) Lot Size Calculator from MyFxBook

It’s pretty straightforward. Remember to specify your account currency. Traders tend to miss that out, resulting in the wrong lot size.

4) Forex Market Hours from BabyPips

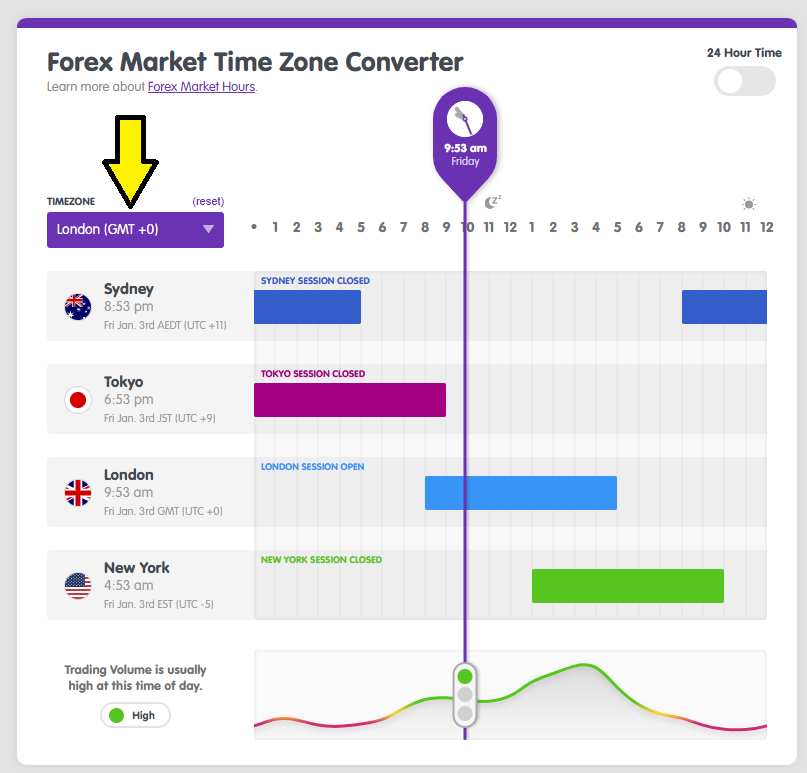

I love this website because it lets me customize the timezone, which is especially helpful when I’m traveling. Since certain currencies tend to move more during the London or New York sessions, this feature makes it easy to pinpoint the hours to trade—or avoid—based on your strategy.

5) ForexFactory Economic News

When major economic news is released, pairs like EUR/USD, GBP/USD, and XAU/USD often experience sharp price movements, making trading highly risky. Forex Factory provides a detailed schedule of these events, helping you plan ahead and avoid trading during volatile hours or days. From an algo standpoint, we will cease all trades for a specified duration before such news and continue after there are signs of a stable market.

6) Forex Correlation by Mataf (link 1) and MyFxbook (link 2)

As an algorithm creator, avoiding highly correlated forex pairs is crucial to maintaining diversification.

If two similar trade setups arise in highly correlated pairs, it’s better to select just one. Taking trades in both pairs effectively doubles your risk, which is something to avoid for prudent risk management.

7) FinancialJuice

This website delivers news at lightning speed—whether it’s the election results of Donald Trump, the impeachment of South Korea’s president, or any unexpected, market-moving events. For even faster updates, I also follow this X account (https://x.com/DeItaone) with notifications turned on, ensuring I’m always in the loop.

This tells you whether most traders are going long or short on any forex pairs. I tend not to use it as I don’t find it reliable back in those days as a manual trader or as an algo creator.

That’s all! Like this post? Please share it with others.

PS: If there are other useful websites, please let me know via blufxnet@blufxnetgmail-com